Since 1979 we have been on a simple mission – to partner with our stakeholders and make great quality products accessible to all. Over time we have grown into an international company in the baby, feminine and adult care categories, trusted by people of all generations, to make their everyday lives that little bit easier.

production facilities

revenue in 2023

R&D centers

Brands

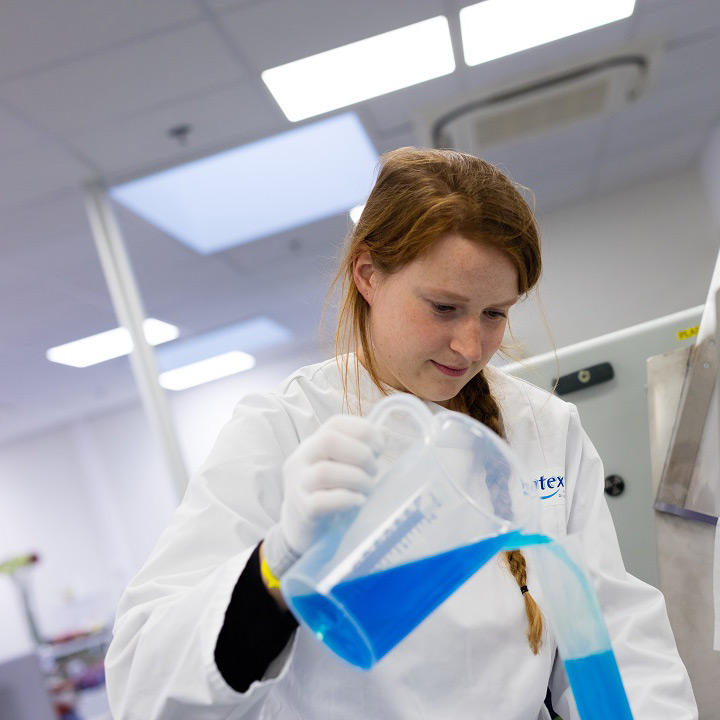

People are at the heart of everything we do.

Consumers know they can rely on us for maximum protection and comfort.

Our partners –retailers and institutional and private healthcare providers- know we never compromise on quality or service.

Read our 2023 Annual Report

Our News & Stories

Ontex announces details for its Q1 2024 results publication

12/04/2024

Ontex will share its results for the first quarter of 2024 at 07:00 CEST / 06:00 BST on Friday, May 3, 2024.

Ontex publishes annual report and convenes its annual general shareholders’ meeting

03/04/2024

Ontex has published its 2023 integrated annual report and related documents and convenes its annual general shareholders’ meeting to be held at its headquarters in Aalst, Belgium, on May 3, 2024.

Ontex completes the divestment of its Algerian business

NewsEventsMergers & Acquisitions

02/04/2024

Ontex announces that it has completed the divestment of its Algerian business to Hygianis SPA, its local distributor for more than 20 years. The transaction includes Ontex’s production facility and business in Algeria, as well as related exports to certain neighboring countries.

Ontex around the world

Ontex has operations in many markets around the world.

The set-up keeps us flexible and close to our customers and the consumer to make sure that they get the best value from our products.

Sustainability

Everything we do is driven by our desire to make a positive impact on society.

Building trust

Our ambition is to enhance the transparency of our business and lead the way to a fairer society.

Climate action

Our ambition is to have climate neutral operations by 2030.

Sustainable supply chain

Consumers want more than a product that performs as promised. They also want to know where it comes from.

Circular solutions

Estimates say that the global population will reach 8.5 billion by 2030.